Where are you hiding assets? Are they stored away in a locked trunk in your attic? Are they located in boxes stacked on the back wall of your moldy basement? Or did you pile your valuable art and antiques in an off–site storage unit located two towns over from your house? Death and Family Hunt for Hidden Assets

Do you have several passbook bank accounts from various banks scattered in the four towns you once lived in or three 401K Plans from prior employment? Have you hidden jewelry in tattered shoeboxes in the back of a third floor closet or in the zippered interior of an old pocketbook?

More importantly, does anyone know about your hidden treasures? Does anyone – a family member, a close friend, or your trusted advisor – actually know what you have and where you have painstakingly placed valuable assets hidden from view?

There was a recent newsworthy story about the death of a “long-lost brother” which led another brother on a tedious and complicated scavenger hunt. After years of breaking all communications and disconnecting from his family, no one in the immediate family knew where the “lost” brother lived and, quite sadly, did not know that he had died. There had been no contact for decades. There was no forwarding address. And there was no paper trail of any bank accounts or other assets belonging to the deceased. He died alone and forgotten.

Luckily for the surviving family members, there are people and “bona fide” companies that actually spend their days searching for unclaimed assets. One such company located in New York City engages in these types of searches and alerted two of the decedent’s brothers that their “long-lost” sibling had died at age 84. The “treasure hunter” also alerted the brothers that their estranged brother had left behind some untouched bank accounts with just over $80,000 in them. The discovery of these two abandoned bank accounts were the first of many discoveries – and as it turns out, only the tip of the iceberg.

As the scavenger hunt began, not surprisingly, the family members began to fight. This resulted in a lengthy and costly legal case over the distribution of the “found” hidden assets. After the search was over, the estate ended up amounting to just shy of one million dollars.

These stories, while admittedly amazing and quite strange, happen all of the time. Why? Because people tend to hide valuable things and often, when a life-changing event happens, there are no breadcrumbs left behind on the floor to help lead the way to find the treasure.

Do your friends and loved ones a huge favor and leave behind some breadcrumbs. Leave a map. Leave a “guide” for the sake of your family. Your treasure map will save your family time, money, stress and the family pressures associated with a life-changing event.

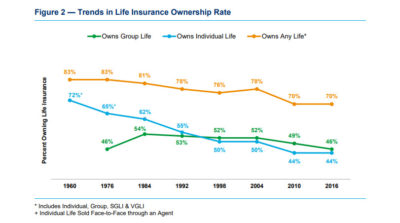

As you can see from the chart above, the rates for men are higher than for women. This is because women typically live longer than men and the company is able to spread the cost of insurance over a longer period of time.

As you can see from the chart above, the rates for men are higher than for women. This is because women typically live longer than men and the company is able to spread the cost of insurance over a longer period of time.